Working exclusively on poker gaming software, our company serves clients and partners from nearly every country and territory, totaling about fifty-two regions where online gambling is permitted. The success of each gaming business hinges on a mathematical equation encompassing initial costs, operational expenses, and jurisdictional capabilities. We firmly believe that you must know about about gaming license conditions, regulations, RNG accpetance as well as the costs involved.

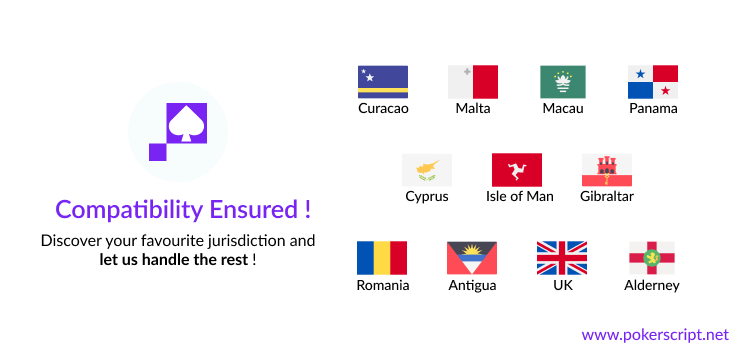

Licensing Jurisdictions

In the following sections, you will discover a comprehensive overview of the popular territories and jurisdictions where we have operated, and our poker software is fully compatible with these locations.

1-Curaçao

Curaçao is an ideal online gambling jurisdiction that specifically caters to supporting startups. It offers a range of services, including IT infrastructure, hosting support, and payment gateways.

Master licenses are valid for five years and can be sub-licensed to an unlimited number of operators.

Games Allowed:

All types of casino game, sports betting and poker.

License Cost:

$12,000 - $18,000 USD. This fee is negotiable.

Revenue Tax Rate:

Corporate income tax is just 2% with Zero GGR.

Corporate Setup:

Local Curaçao Company

2-Malta

In Malta, the Lotteries & Gaming Authority (LGA) is responsible for issuing licenses to online poker operators. Being a member of the British Commonwealth and the European Union (EU), Malta's licenses are recognized and accepted in numerous countries worldwide, including the UK residents.

For poker, a Class 2 type of gambling license is applicable as it falls under the category of pool betting, which involves betting against other players.

Games Allowed:

Casino games, skill games, slots, poker, roulettes, lotteries and betting exchanges.

License Cost:

$8,500 - $25,000 USD, based on licnese type.

Revenue Tax Rate:

5% GGR.

Corporate Setup:

EU company

3-Macau

Macau is known as the gambling hub for land-based casino games. Technically, there are no laws, rules, and regulations to control online gambling. For land-based setups, licenses are released by the Macau Government through an open tender process.

Online poker sites can operate freely in this location since there are no restrictions or rules that limit online gambling.

Games Allowed:

Casino games (slot, rulette, blackjac etc.), poker, bingo, fantasy betting and lotteries.

License Cost:

Not Required

Revenue Tax Rate:

Zero GGR.

Corporate Setup:

Local/Foreign Company

4-Cyprus

In Cyprus, the National Betting Authority (NBA) regulates gambling licenses under the "Article 24" of the Betting Law 2012. Type B license is suitable for online operations encompassing sports betting, games of skill, and other related activities.

Games Allowed:

Sports betting & poker (game of skill).

License Cost:

$30,000 USD

Revenue Tax Rate:

13% GGR.

Corporate Setup:

EU company

5-Kahnawake

The Kahnawake Gaming Commission is responsible for issuing online poker room licenses, with a mandatory requirement that the data center must be situated within the Mohawk Territory of Kahnawake and operated by Continent 8 Technologies.

Games Allowed:

Sports betting, poker, live casino games, video games, slots etc.

License Cost:

$40,000 USD

Revenue Tax Rate:

Zero GGR.

Corporate Setup:

Local Company

6-Panama (Best Choice)

The Panama Gaming Control Board provides online gambling licenses for operators to run all kinds of electronic games of chance, including wagering activities. A master license holder can grant sub-licenses to operate their own white-label casino solutions

Games Allowed:

All kind of electronic games such as poker.

License Cost:

$40,000 USD

Revenue Tax Rate:

5.5% GGR.

Corporate Setup:

Local/Foreign Company

7-Isle of Man

The Isle of Man Gambling Supervision Commission (GSC) grants a "Full License" to online gambling companies, enabling them to conduct both Business-to-Customer (B2C) and Business-to-Business (B2B) operations.

License holders have the authority to sub-license to third parties, permitting them to utilize their own private label solutions.

Games Allowed:

All games (online/offline) including poker.

License Cost:

£35,000

Revenue Tax Rate:

1.5% GGR

Corporate Setup:

Local Company

8-Gibraltar

In Gibraltar, the Ministry of Finance is directly responsible for handling licensing and regulatory matters, which contributes to its widespread acceptance worldwide.

Games Allowed:

Casino gaming, betting, lotteries, social gaming and poker.

License Cost:

£30,000

Revenue Tax Rate:

0.15% GGR.

Corporate Setup:

Local Company

9-United Kingdom (Britain)

The United Kingdom Gambling Commission (UKGC) issues a specific license called the 'remote casino operating license', which is applicable for online poker. This license covers all the games that you may distribute through websites, apps, TV, and other internet services.

Games Allowed:

Onilne gambling games including poker.

License Cost:

£4,224 - £91,686 based on turnover.

Revenue Tax Rate:

21% GGR.

Corporate Setup:

Local Company

10-Alderney

The Alderney Gambling Control Commission (AGCC) provides a comprehensive global eGaming licensing that covers both EU and Non-EU countries for both B2C and B2B models.

Games Allowed:

Onilne gambling games including poker.

License Cost:

£35,000

Revenue Tax Rate:

Zero GGR.

Corporate Setup:

Local/Foreign Company

11-Antigua

In Antigua, the Financial Services Regulatory Commission (FSRC) manages the gambling license, which encompasses interactive gaming, wagering, and also covers land-based casino operators.

Games Allowed:

All games (online/offline) including poker.

License Cost:

$100,000 USD

Revenue Tax Rate:

3% GGR.

Corporate Setup:

Local/Foreign Company

12-Romania

The Ministry of Finance in Romania is responsible for issuing the gambling license. To operate your own game, a Class 1 license is required, which must be hosted within the Romanian territory.

Games Allowed:

All games (online/offline) including poker.

License Cost:

$6,000 USD – $120,000 USD based on turnover.

Revenue Tax Rate:

16% GGR.

Corporate Setup:

Local Company

RNG Testing Labs

Request your RNG certificate from any of the listed authorities. We have prior experience with all of them and are prepared to assist you in obtaining your personalized certificate for your domain.

1-iTech Labs

iTech Labs is an ISO/IEC 17025 accredited testing laboratory that offers RNG certification services for online gaming and online gambling software. They are widely recognized and trusted in the industry.

2-eCOGRA (eCommerce Online Gaming Regulation and Assurance)

eCOGRA is an independent testing agency specializing in the certification of online gaming systems. They offer RNG certification services to online casinos and gaming software providers.

3-BMM Test Labs

BMM Testlabs is another internationally recognized gaming testing laboratory. They provide RNG certification services along with a wide range of testing and certification services for the gaming industry.

4-GLI (Gaming Laboratories International)

GLI is a global testing and certification company that provides services to the gaming, lottery, and iGaming industries. They offer RNG testing and certification to ensure fairness in gaming software.

5-TST (Technical Systems Testing)

TST is an internationally recognized testing and certification agency for the gaming industry. They provide RNG evaluation and certification services for various gaming software platforms.

As a poker script provider, we have dealt with these organizations before, and we are here to assist you. All commercials and document-related discussions will be conducted directly with the providers, while we will help you handle the technical aspects only.

Please let us know your choice, and we can start collaborating on the project. We're excited to begin this journey with you!